SPACs – SPECIAL PURPOSE ACQUISITION CORPORATIONS

A Special Purpose Acquisition Corporation (“SPAC”) also known as a Special Purpose Acquisition Company is a company with no commercial operations and is created by a SPAC sponsor specifically to raise capital through an Initial Public Offering (“IPO”) for the purpose of acquiring an existing company or companies in a specific industry. This is called the Qualifying Transaction (“QT”). The acquisitions can include asset purchases.

Special Purpose Acquisition Companies have listed on the NASDAQ, New York Stock Exchange (“NYSE”), London Stock Exchange (“LSE”), and the Euronext Amsterdam Stock Exchange.

Even though Special Purpose Acquisition Corporations have been around since the 1990’s, recently they have seen tremendous growth. For instance, in the US over US$62 billion which is up from a total of US$13 billion in 2019. This has been raised through 169 SPAC IPOs as of October 30, 2020. The average SPAC IPO size is US$369 million.

As a result, SPACs have gain popularity in Canada as well. The resurgence in Canada is partly attributed to cannabis focused SPACs whose target market is US cannabis assets.

SPECIAL PURPOSE ACQUISITIONS CORPORATIONS IN CANADA

There are two stock exchanges in Canada that allow the listing of SPAC’s, the TSX- Toronto Stock Exchange and the Neo Exchange. Regarding SPACs focused on US cannabis, the Neo Exchange is the only stock exchange in Canada that allows them.

SPECIAL PURPOSE ACQUISITION CORPORATION INITIAL PUBLIC OFFERINGS

The TSX requires a minimum IPO raise of $30 million. Neo requires a minimum public float of $30 million upon listing.

Founders who are usually the SPAC sponsor must also subscribe for units, shares, or warrants of the SPAC. On the TSX the founders must have equity ownership of between 10% – 20% of the SPAC post IPO. On the Neo Exchange, there is not a minimum. Having said that the founders cannot have equity ownership of the SPAC of more than 20% post IPO.

Upon listing a majority ~90% of the monies raised must be into escrow with a trustee until after the qualifying transaction.

A majority of Special Purpose Acquisition Company’s prospectus’ in Canada state that there is no compensation for the management or board of directors until after the Qualifying Transaction. Directors along with management receive founders’ shares.

ACQUISITIONS & QUALIFYING TRANSACTION

SPACs have 36 months to acquire businesses or assets valued at 80% or more of the capital raised in the IPO. Many SPACs lower the 36 months time frame which can increase the potential targeted investment pool.

After there are definitive agreements with the targeted business(es) and asset(s), the SPAC will go through a qualified transaction. This will include a prospectus filing and if needed another public offering of securities. The prospectus filing will require audits of all the assets that are being acquired.

A SPAC can use its securities for the acquisition as payment or securities and cash or just cash.

Please note that a Special Purpose Acquisition Company must get majority unitholder approval for the acquisition(s). This approval must be by public holders of the SPAC. Founding shareholders are not entitled to vote their securities on the acquisition. The public holders who vote against the qualifying transaction will be able receive their investment back from the escrowed funds.

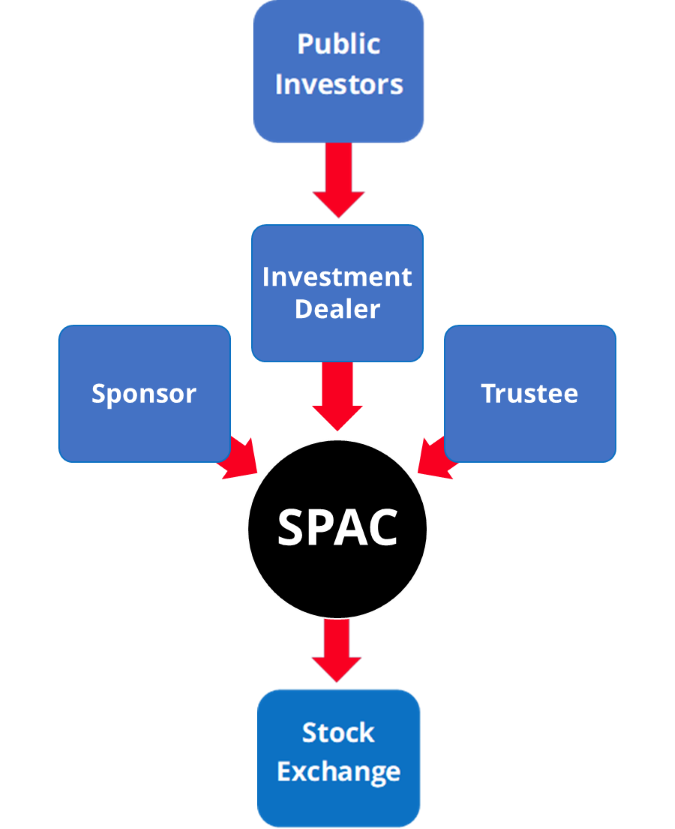

SPAC STRUCTURE

In general, the components needed to raise capital and list a SPAC are as follows:

SPAC SPONSOR

This is the company that creates the SPAC and is formed by the founders. The SPAC Sponsor Holding Company raises the preliminary capital for the SPAC. The amount needed varies but investors want to see a financial commitment from the SPAC Sponsor company. A good rule of thumb would be 5% of the entire amount raised from the IPO. The SPAC Sponsor Company may or may not have members of it as the management and directors of the SPAC. The SPAC Sponsor company will also be issued founder shares in addition to the shares received from the initial investment.

INVESTMENT DEALER

An Investment Industry Regulatory Organization of Canada (“IIROC”) investment dealer as the lead sponsor is required for the IPO and to raise the rest of the capital. The financing will be in the form of units that investors subscribe for. The units usually comprise one common share and a warrant to purchase a common share at a set price in the future. Most SPAC units are priced at $10 per share.

TRUSTEE

A trust account is created where the capital raised through the SPAC IPO will placed in the account. The funds will typically be invested in short-term government securities or held as cash. The funds are released to fund the acquisition of businesses and to cover any transaction expenses and working capital of the company.

If you are looking at creating a SPAC you need to prepare. A Going Public Management Consultant (“GPMC”) with experience in Special Purpose Acquisitions Corporations can assist you with it. Some of the items the GPMC can assist with is:

- Forming the right Board of Directors;

- Business Plan;

- Marketing Materials for the Investment Dealers i.e. presentation;

- Acquiring experienced SPAC professionals such as lawyer, auditors;

- Selecting and acquiring the right IIROC investment dealer as not all of them work on SPACs.

In conclusion listing a Special Purpose Acquisition Company is not for everyone. There are some key attributes that you need to have for a successful SPAC IPO. Contact us if you would like to learn more about creating a Special Purpose Acquisition Corporation. Additionally, if you would like to take your company public through an already listed SPAC, please fill out the form on the right. A member of our team will contact you.