INITIAL PUBLIC OFFERINGS IN CANADA

The Initial Public Offering (“IPO”) is the most well-known method of going public but is not the most used method of going public in Canada. A vast majority of new listings in Canada is through the Reverse Takeover (“RTO”) route. After that, IPOs account for approximately 10% of new listings in Canada. Discover if an IPO prospectus is right for you. Find out what team members you need in addition to the Investment Industry Organization of Canada (“IIROC”) lead sponsor.

The IPO consists of an ‘offering prospectus’ also known as a prospectus with distribution. The two main requirements to list on a stock exchange in Canada is reporting issuer status and shareholder distribution. In addition, the Toronto Stock Exchange – TSX, TSX Venture Exchange – TSXV, the Neo Exchange- Neo, and the Canadian Securities Exchange – CSE have different shareholder distribution requirements. Similarly, the RTO route also achieves reporting issuer status and shareholder distribution.

WHY AN INITIAL PUBLIC OFFERING?

The main component that is required for an IPO is investment dealer sponsorship. The lead sponsor of the Initial Public Offering is an Investment Industry Regulatory Organization of Canada member firm. You might have more than one dealer involved but that will be decided by the lead sponsor. For instance, a lead sponsor will typically market 60-70% of the financing to its investors. Concurrently, they will provide 40-30% of the financing to the other IIROC firms known as the selling group.

IS AN INITIAL PUBLIC OFFERING RIGHT FOR YOU?

It depends. For instance, if your main concern is the financing and the investment dealer feels that they can complete the financing with a few institutional investors, they might prefer that the company go the Reverse Takeover route. In other words, the institutional investment might not fill the shareholder distribution requirement.

WHO DO I NEED ON MY TEAM?

Your IPO team should consist of:

Going Public Management Consultant (“GPMC”)

A good going public management consultant will assist you in finding the right lawyers, auditors, and IIROC investment dealers. They will also assist with putting together the right documentation for marketing your company to IIROC investment dealers as well as organize the process and manage all of the pieces so that you can focus on your business. The GPMC will also plan out your investor relations and market awareness programs and bring in the right investor relations personnel.

Investment Dealer/Sponsor

You will need and IIROC registered dealer for your IPO. There are over 60 registered IIROC dealers that sponsor IPOs. It’s a matter of getting the right one. Your going public management consultant arrange the right one(s). Sometimes is it beneficial to have two or more co-leads along with the selling group. That decision will largely depend on the size of your financing.

There are many good Exempt Market Dealers (“EMDs”) out there. However, they cannot sponsor an IPO nor can they receive commission on the raising of IPO funds.

Lawyer

Finding the right lawyer can be hard to achieve. This is an area where costs can get out of hand if you’re not careful. Your going public management consultant can assist with finding a lawyer that provides high quality work at a reasonable price. Look for a lawyer who will give you a fixed cost flat rate.

Auditor

Even though your initial audits for going public are not required to be done by a CPAB auditor it would be good to start with one. Subsequent to your public listing your audits must be done by a CPAB auditor. Therefore, transitioning after being public could cause issues. Even better find one that is also PCAOB registered.

Learn more about your IPO team and other going public considerations by clicking here – Going Public Considerations.

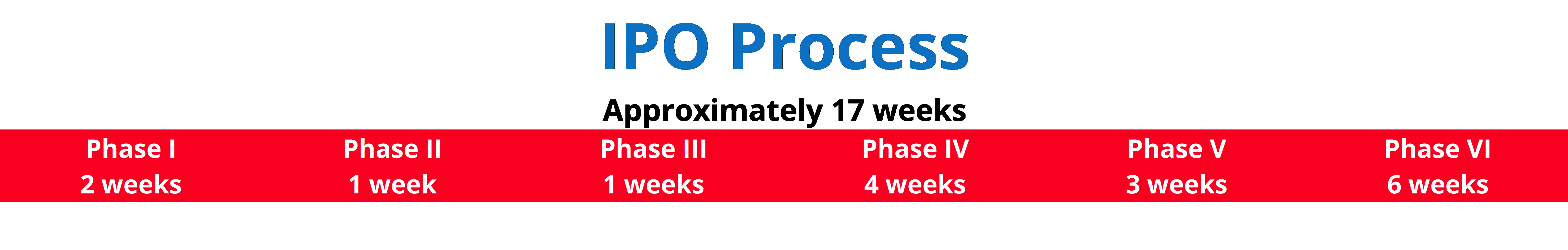

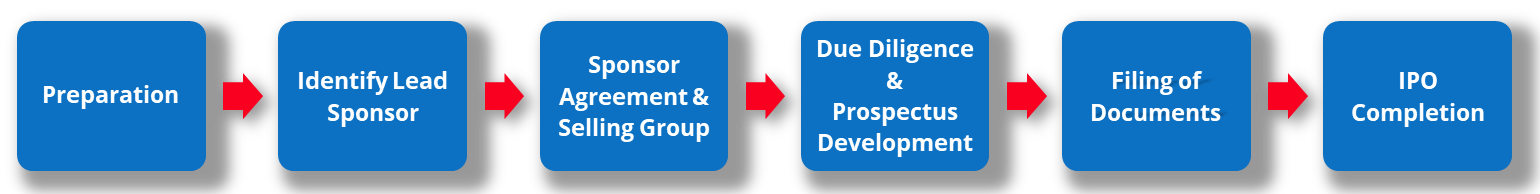

IPO PROCESS

For a successful IPO it is better to start sooner than later. You could complete the process in 4.5 months, but will it be successful? Its better to start sooner and work with your GPMC who will help you gain interest from multiple investment dealers as well as the overall investment community. This is a strategic plan that will greatly pay off in the medium and long term, especially on your valuation. You might want to start off with a private placement before the going public transaction.

Below is an overview of the IPO process:

With external delays, this will include your auditor, lawyer, IIROC investment dealer. They could be overbooked with transactions which will cause you delays. Again, your GPMC will assist by choosing the professionals that can complete your IPO transactions in a timely manner.

Summary

Lastly, you will need to choose the stock exchange for your IPO. This could be determined by numerous factors including whether you want to be on a non-venture or venture issuer exchange and the listing requirements of the different stock exchanges in Canada.

In conclusion, an IPO might be a suitable method to go public but there are many factors that will determine if it is the best path. Therefore, if you would like to learn more about completing an IPO and whether it is right for you, please fill out the form above to the right. A member team will contact you.