Are you thinking of Going Public in Canada? Looking for Investment for your Products, Services, or Business Plan? Are you contemplating Venture Capital? Or perhaps you need a source of ongoing capital to properly grow your business? This article goes over the main methods of going public in Canada. This includes prospectus listings, including offering and non-offering, and reverse takeovers – RTOs.

Canada has a robust capital market, as well as strength in funding growth ventures in emerging industries. Getting access to funding opportunities can be facilitated by becoming a public company. There are four recognized stock exchanges in Canada including the Neo stock exchange or the CSE stock market.

Being a Publicly Traded Company gives you access to the Canadian Capital Markets and the many pools of Public Venture Capital that are available to emerging companies. Therefore, being public raises your corporate profile and puts you “on the radar” as a suitable investment opportunity for investors.

In Canada, the main are the Toronto Stock Exchange (TSX), Neo stock exchange (NEO), the TSX Venture Exchange (TSX-V), and the Canadian Securities Exchange (CSE).

We invite you to consider the advantages of each recognized stock exchange in Canada as a destination to take your company public.

How do I take my Company Public in Canada?

Companies that go public on a stock market in Canada become a reporting issuer with one or more of the Provincial Securities Commissions. Therefore, once a company becomes a reporting issuer, it is subject to ongoing public disclosure and reporting requirements. In addition, all companies listed in Canada meet the shareholder distribution requirements which range from 150 – 300 shareholders.

The definition by the securities commissions of a Reporting Issuer is:

“A company that has issued shares to the public and is subject to continuous disclosure requirements by one or more of the provincial securities commissions.”

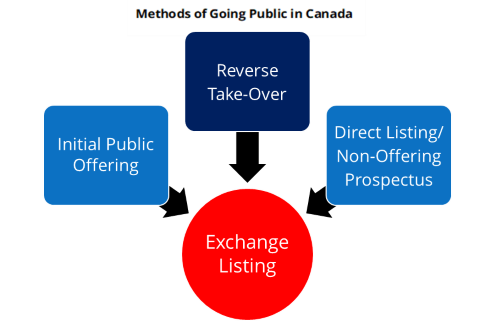

Companies can become a reporting issuer in Canada in many ways. Two of these include qualifying a Prospectus, or completing a Reverse Takeover with a reporting issuer. Each company on the NEO Exchange and CSE is a reporting issuer in one or more province.

However, if you are not currently a reporting issuer there are many methods to achieve this status. This includes a merger or an amalgamation with a reporting issuer, a Non-Offering or Offering Prospectus or completing a Reverse Takeover (RTO).

One of the common methods used by companies looking to go public are through filing and clearing a prospectus with at least one Provincial Securities Commission. The other is completing a Reverse Takeover Transaction (RTO) with an existing reporting issuer:

Prospectus

Companies can become reporting issuers by filing and clearing a prospectus. There are two types of prospectus’: an offering prospectus or a non-offering prospectus. Prospectuses must contain full, true and plain disclosure to investors and the public about the company.

Offering Prospectus or Prospectus with Distribution

This type of prospectus is issued when a company offers to sell its shares to the public in an IPO or Initial Public Offering. In addition, with an IPO you would need to have one of more dealers as agents who can raise the required funds your company requires. They must also be able to place those funds with shareholders. Furthermore, they will need to meet the targeted stock exchange’s shareholder distribution requirements.

Non-Offering Prospectus or Prospectus without Distribution

A company may also choose to file a non-offering prospectus. A non-offering prospectus has the same disclosure requirements as an offering prospectus. However, there is no intention to sell shares to the public. The primary purpose of filing a non-offering prospectus is to become a reporting issuer. Therefore, a company will only consider this if it already has met the shareholder distribution rule of the stock exchange they are striving to list on. Companies that take this path usually do not need an immediate financing.

Reverse Takeover (RTO)

An RTO is a transaction between the private operating company and an existing reporting issuer also known as a shell. The operating company’s business is rolled into the shell. Therefore, the operating company’s shareholders get a controlling interest in the new, combined company.

Shells

The term “shell” for reporting issuers is used because these issuers have ceased operations. They still maintain their reporting issuer status and usually have the shareholders required to list on a stock exchange. This makes them ideal candidates to complete an RTO transaction to take a private company public.

An RTO can be a short road to failure if not done correctly. You must find a clean shell. For instance, a clean shell is one without significant debt and contingent liabilities. Even though the above might not be in the financial statements, it would be good to protect yourself from these in your agreements with the shell.

Values of shells go up and down based upon supply and demand. Therefore don’t settle for a shell that is over priced or has large debt. If it does have a small amount of debt see if that can be converted into shares. The only debt that cannot be converted is auditors fees. However, these fees are a small amount as the shell does not have operations.

In conclusion, if you are interested in going public and you currently meet one of the recognized stock exchanges listing requirements or will meet them following a public offering, we encourage you to contact us. We can assist you in completing the listing or meeting the requirements.